Investment Funds

The Foundation offers a choice of 4 pools as investment funds.

In keeping with the investment guidelines of the United Methodist Church, the Investment Committee of the Foundation seeks to be socially responsible in the way in which it invests the funds it oversees, reflecting the ethical standards of the Church. The United Methodist Church’s Book of Discipline provides a guideline that seeks avoidance of investments that appear likely “to support racial discrimination, violation of human rights, sweatshop or forced labor, gambling, or the production of nuclear armament, alcoholic beverages or tobacco, or companies dealing in pornography.” It is the policy of the Foundation to seek to avoid direct investments in such companies.

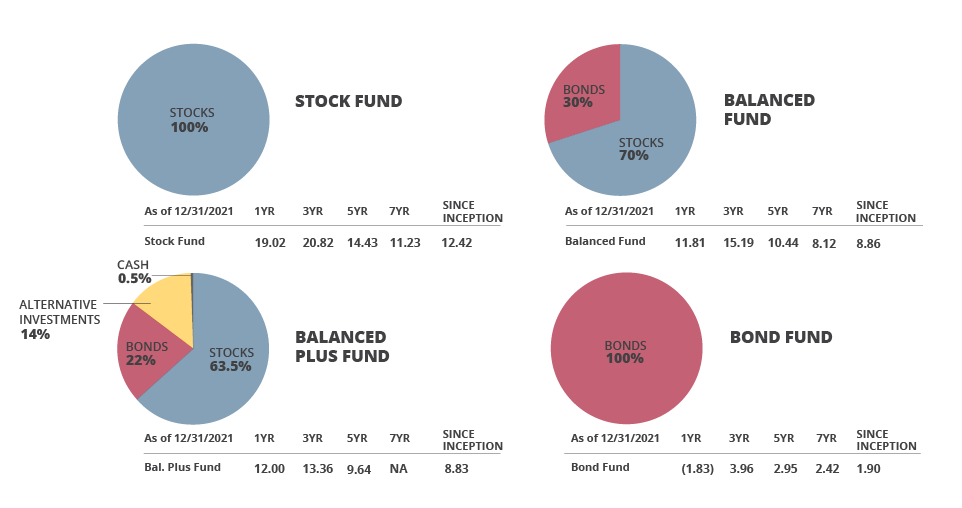

Balanced Fund

The overall goal of the Balanced Fund is to provide both income and growth of capital while avoiding excessive risk and volatility. The Balanced Fund’s portfolio has an asset allocation mix that consists of equities, fixed income, and cash. The fund attempts to mitigate the wide fluctuations sometimes experienced in the overall stock market through diversification among different asset classes.

Balanced Fund Plus

The overall goal of the Balanced Plus Fund is to provide both income and growth of capital while avoiding excessive risk and volatility with an allocation to alternative investments that is an asset class that can be less correlated to traditional assets. The Balanced Fund’s portfolio has an asset allocation mix that consists of equities, fixed income, cash, and alternatives. The fund attempts to mitigate the wide fluctuations sometimes experienced in the overall stock market through diversification among different asset classes.

Stock Fund

The overall goal of the Stock Fund is to provide growth of capital primarily through appreciation. The Stock Fund’s portfolio has an asset allocation mix that consists of equities and cash. This fund attempts to mitigate some of the wide fluctuations experienced at times in the overall stock market through diversification among different equity sizes and styles. As with any investment that is focused on excess return, higher volatility can be experienced as well.

Bond Fund

The goal of the Bond Fund is to provide income, liquidity, and a total return that exceeds that of core inflation. The Bond Fund’s portfolio has an asset allocation mix that consists of intermediate and short term maturity bonds and cash. While some volatility still remains within a bond portfolio, it is normally less than that experienced in a stock portfolio. The fund provides this lower volatility by bond type diversification and the short-intermediate maturity nature of this fund.

** This website does not constitute, and must not be construed as, an offer to sell or the solicitation of an offer to purchase the securities identified on the site. Such offers may legally be made or solicited only by way of a written offering circular containing full and fair disclosure of all material information, a copy of which may be obtained by contacting the Virginia United Methodist Foundation at 804-521-1121.